Technology plays a central role in our lives, offering convenience, entertainment, and productivity. However, without careful consideration, it’s easy to fall into traps that lead to wasted money on technology. In this guide, we explore common ways people unknowingly squander their hard-earned cash

1. Extended Warranties

Buying extended warranties for electronics might seem like a safety net, but often, they’re not worth the cost. Most devices outlive the warranty period without issues, making this extra expense unnecessary.

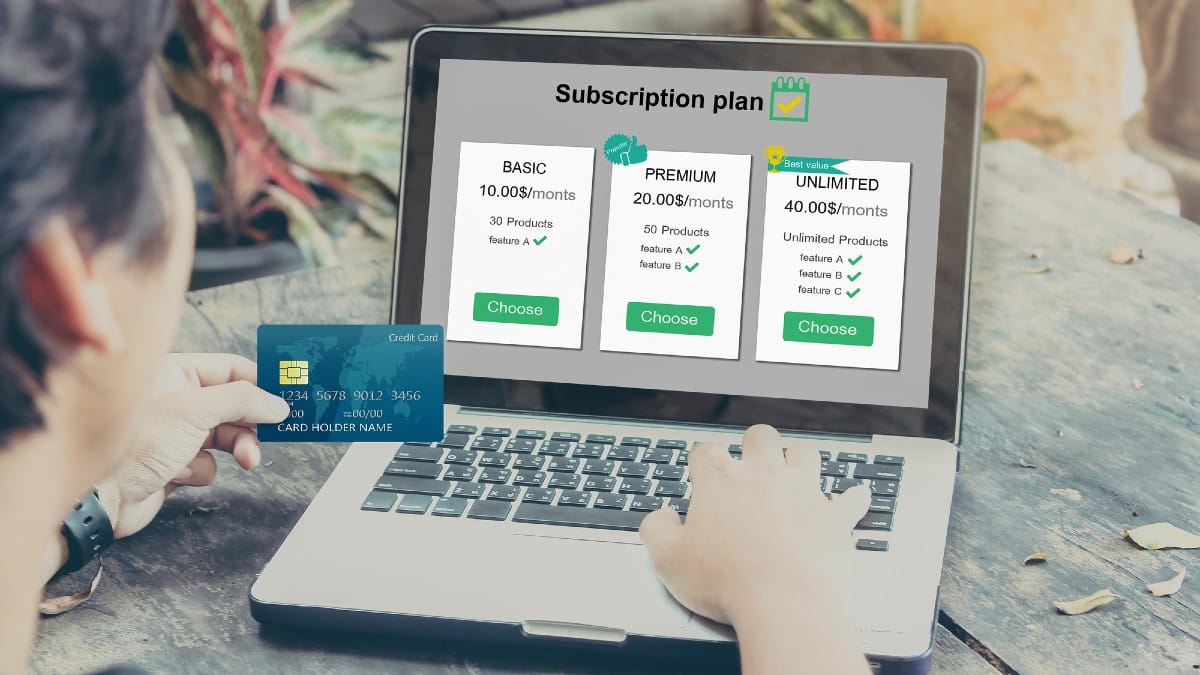

2. Unused Subscriptions

Streaming services or app subscriptions that go unused are like gym memberships in January—full of good intentions but often forgotten. Regularly review and cancel those you don’t use to avoid these silent budget drains.

3. Latest Gadget Syndrome

Constantly upgrading to the latest tech gadget can wreak havoc on your finances. The truth is, last year’s model often works just as well. Skipping a generation or two between upgrades can lead to significant savings.

4. Overpriced Accessories

Brand-name accessories come with hefty price tags. Searching for generic versions can save a bundle without sacrificing quality. It’s like choosing a no-name brand at the grocery store—just as good for a fraction of the price. A study by Technomic found that brand-name phone cases can be marked up by as much as 1,000% compared to generic alternatives.

4. In-app purchases

Small in-app purchases can quickly add up to a large bill. It’s akin to nibbling snacks without realizing how much you’ve eaten. Setting a budget for digital spending can keep this habit in check.

5. Not Shopping Around

Impulse buying the first tech option you see is easy, but not always wise. A little research could reveal a better deal elsewhere. Think of it as hunting for hidden treasure. The prize is savings on the same gadget.

6. Overpaying for Brand Names

Sticking to well-known brands can sometimes mean paying more for the logo than the technology. Comparable quality can often be found in less famous brands. It’s like choosing a no-name cereal that tastes the same as the leading brand but at a fraction of the cost.

7. Ignoring Refurbished or Used Devices

Many shy away from refurbished or used tech, fearing reliability issues. However, certified pre-owned devices can offer substantial savings and often come with warranties. It’s akin to buying a pre-loved book that reads just as well as a brand-new one.

8. Falling for Unnecessary Features

Paying extra for features you don’t need is like buying a Swiss Army knife when you only need a screwdriver. Evaluate what features you will use before purchasing to avoid paying for bells and whistles that go unused.

9. Not Using Available Discounts

Skipping over available discounts or promo codes is leaving money on the table. Students, military personnel, and even association members often qualify for tech discounts. It’s like ignoring a coupon for your favorite coffee shop.

10. Lack of Research on Alternatives

Automatically buying the newest model without considering alternatives is a missed opportunity for savings. Sometimes, last year’s model or a different brand offers nearly identical features at a lower price. It’s like choosing an expensive direct flight without checking if there’s a cheaper one with a short layover.

11. Buying on Credit Without a Plan

Purchasing tech gadgets on credit without a repayment plan can lead to interest payments that far exceed the original price. It’s akin to letting a small leak sink a big ship over time. Always have a clear plan to pay off the balance before interest accrues.

12. Not Utilizing Cashback and Reward Points

Ignoring the benefits of cashback offers and reward points is like turning down free money. Using a rewards credit card for tech purchases, and then paying off the balance immediately can earn back a percentage of the cost. It’s an effortless way to save on every purchase.

13. Skipping Energy Efficiency Considerations

Overlooking the energy efficiency of tech devices can result in higher utility bills. Opting for energy-efficient models is like choosing a car with better fuel mileage; it saves money in the long run. Look for the ENERGY STAR label to guide your choices.

14. Not Selling or Recycling Old Tech

Holding onto outdated gadgets collects dust and misses out on potential cash. Selling old devices or recycling them responsibly can offset the cost of upgrades. Think of it as trading in old textbooks at the end of the semester.

15. Impulse Buying During Sales

Getting swept up in sales and buying gadgets just because they’re discounted can lead to unnecessary spending. It’s like filling your shopping cart with items you don’t need just because they’re on sale. Always ask if the device is something you were already planning to buy or if it truly meets a need.

50 Super Simple Side Hustle Ideas

50 Super Simple Side Hustle Ideas (& How to Make Them Work)

10 Frugal Lessons I Learned From Being Flat Out Broke

10 Frugal Lessons I Learned From Being Flat Out Broke

Creative Ways To Make Money

20 Easy Ways to Raise A Credit Score Fast

Read More: 20 Easy Ways to Raise A Credit Score Fast

Frugal Living Tips: The Essential Guide To Start Saving Money

Frugal Living Tips: The Essential Guide To Start Saving Money

Get more stories from Bento Bucks on money hacks and trending money news!

Get more stories from Bento Bucks on money hacks and trending money news!