Navigating the paradox of earning well but feeling broke is a modern-day dilemma for many high earners. It’s a puzzling situation, where hefty paychecks disappear as quickly as they come. This guide aims to unravel this mystery, offering actionable strategies for those who find their bank accounts bafflingly barren despite a good income.

1. Emergency Fund First

Financial experts shout it from the rooftops for a reason. Before splurging, stash away at least three months’ living expenses. It’s your financial safety net. This fund turns a crisis into a hiccup.

2. Invest Wisely

Let your money grow. Diversify investments to include stocks, bonds, and real estate. Passive income streams can become a river over time. Research and patience in investing pave the way to wealth.

3. Budget Like a Boss

Tracking every penny sounds tedious but enlightens on where cash flows. Apps now make this less of a chore. A clear budget creates a roadmap for financial success.

4. Avoid Debt’s Trap

Credit cards are not free money. Pay balances in full monthly. Interest fees devour budgets. Studies show consistent overuse of credit leads to long-term financial instability. Debt-free living liberates financially and mentally.

5. Seek Professional Help

A financial advisor isn’t just for the ultra-rich. They tailor plans to boost savings and reduce taxes. Worth every penny. Their expertise can navigate you through financial storms.

6. Mindful Spending

Impulse buys add up. Question every purchase. Need or want? Delay gratification and reap rewards later. This discipline strengthens financial resilience.

7. Negotiate Bills

Service providers often bend on rates to keep loyal customers. A simple call can lower monthly expenses significantly. Savings found here can fuel other financial goals.

8. Smart Grocery Shopping

Plan meals, use lists, and avoid shopping hungry. Food waste equals money waste. Bulk buys on staples save in the long run. This practice cuts costs and supports healthier eating.

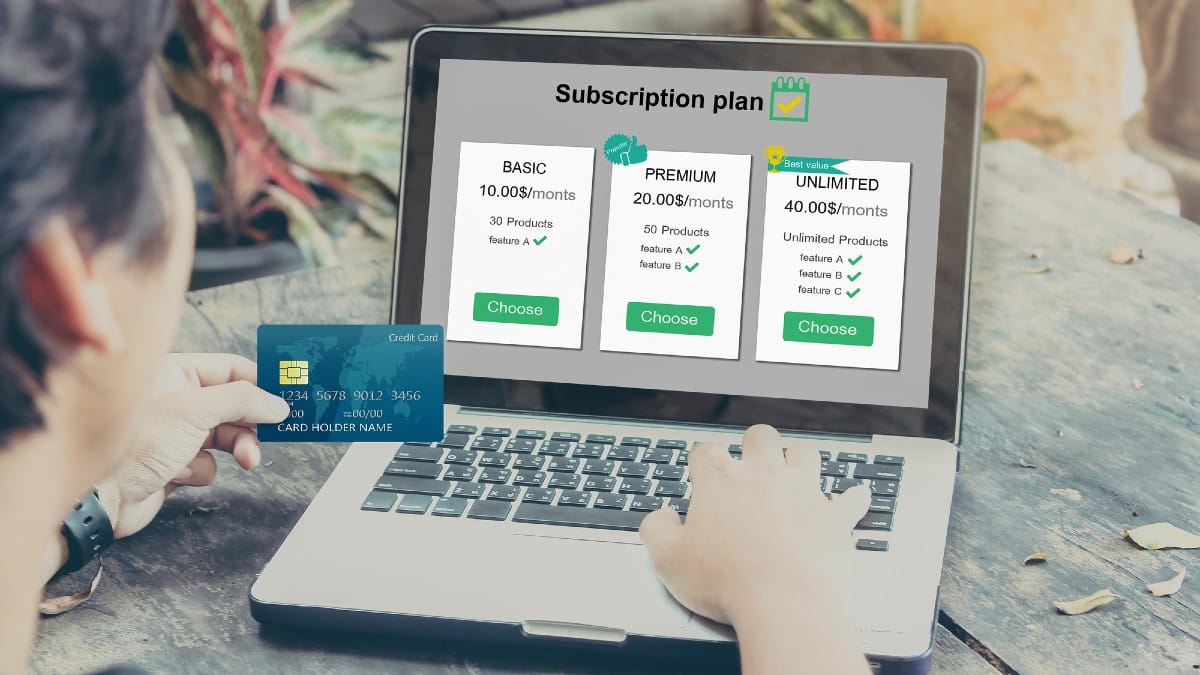

9. Review Subscriptions

Streaming services, gym memberships, apps. If unused, they’re draining funds. Cancel mercilessly. Reevaluate regularly to keep subscriptions in check with actual usage.

10. Education Investment

Learning boosts earning potential. Online courses or certifications pay off by advancing careers. Continuous learning keeps you competitive and opens new opportunities.

11. Insurance Check-up

Regularly review policies. Overinsurance is as bad as underinsurance. Get what you need, no more, no less. This ensures you’re not overpaying for coverage you don’t need.

12. Retirement Contributions

Max out. Especially if there’s an employer match. Leaving this on the table is like saying no to free money. Your future self will thank you for this foresight.

13. Health is Wealth

Medical bills can bankrupt. Invest in health through diet, exercise, and regular check-ups. Preventative care saves more than it costs. A healthy lifestyle wards off expensive medical treatments.

14. Trim the Fat

Luxuries feel essential until you’re scraping for pennies. Swap that daily latte for home brews. Savings will surprise you. Small changes in daily habits lead to substantial savings over time.

15. Generosity with Limits

Supporting loved ones feels right. However, financial boundaries are crucial. Offer wisdom and support, not just open wallets. Teach them to fish, rather than just giving them a fish.

50 Super Simple Side Hustle Ideas

50 Super Simple Side Hustle Ideas (& How to Make Them Work)

10 Frugal Lessons I Learned From Being Flat Out Broke

10 Frugal Lessons I Learned From Being Flat Out Broke

How To Make Money Without a Job

How To Make Money Without a Job

Creative Ways To Make Money

20 Easy Ways to Raise A Credit Score Fast

Read More: 20 Easy Ways to Raise A Credit Score Fast

Frugal Living Tips: The Essential Guide To Start Saving Money

Frugal Living Tips: The Essential Guide To Start Saving Money

Get more stories from Bento Bucks on money hacks and trending money news!

Get more stories from Bento Bucks on money hacks and trending money news!