By ignoring these fundamental habits, individuals unknowingly hinder their chances of achieving financial prosperity. For instance, Many individuals underestimate the power of small, consistent financial practices such as tracking expenses, setting financial goals, and saving a portion of their income regularly.

1. They Live Below Their Means

Millionaires often avoid the trap of lifestyle inflation. As their earnings increase, they don’t rush to upgrade their life with bigger houses or fancier cars. This is a well-established principle for building wealth. Author Thomas J. Stanley in his book found that many millionaires prioritise saving and investing over expensive lifestyles.

2. Budgeting is Their Secret Weapon

Keeping track of where every dollar goes isn’t just for those trying to make ends meet. Millionaires use budgets to ensure they’re investing in their future, not just spending for today. A study by the National Endowment for Financial Education found that those who budget are more likely to reach their financial goals.

3. They Embrace Secondhand

Buying second-hand isn’t about scrimping—it’s about value. Millionaires know that many items, from cars to clothes, lose a chunk of their value the moment they leave the store. Opting for gently used goods can save a fortune, akin to letting someone else take the depreciation hit for you.

4. Continuous Learning and Self-Improvement

Continuous learning and self-improvement are essential habits for financial growth and success. This practice involves consistently seeking new knowledge, skills, and experiences. By continuously improving themselves, individuals can increase their earning potential, and adapt to changes in the marketplace.

5. They Avoid Debt Like the Plague

Avoiding unnecessary debt means millionaires aren’t paying interest; they’re earning it. Whether it’s avoiding high-interest credit cards or paying cash for large purchases, they understand that debt can be a slippery slope. The Federal Reserve in the US advises responsible credit card use to avoid high-interest charges.

6. Automating Savings

Directing money into savings or investment accounts automatically is a game-changer. It’s like the slow but steady drip of a faucet filling a bucket over time. This method ensures they’re always saving without thinking about it. Easy and effective.

7. Smart Grocery Shopping

Clipping coupons and shopping deals aren’t beneath the wealthy. Saving a few dollars here and there adds up. It’s akin to patching leaks in a boat, ensuring it stays afloat and reaches its destination: financial independence.

8. Using Public Transport

Opting for public transportation or biking over driving luxurious cars saves a ton of money on maintenance, fuel, and parking. It’s similar to choosing stairs over the elevator. Both get you to your destination, but one keeps your wallet and health in better shape.

9. Investing in Quality

When millionaires do spend, they buy quality items that last longer, rather than cheap ones that need frequent replacing. It’s like buying a sturdy backpack for hiking. It might cost more upfront, but it won’t rip halfway through the journey, saving money and hassle in the long run.

10. DIY Projects

Doing things themselves, from home repairs to gardening, keeps millionaires’ money in their pockets. It’s comparable to cooking your meal rather than eating out. Both feed you, but one significantly cuts down on expenses.

11. Seeking Out Free Entertainment

Millionaires often enjoy free or low-cost entertainment options. Parks, free community events, and home movie nights trump expensive outings. It’s like finding treasure in your backyard. This habit cuts unnecessary spending, allowing savings to grow.

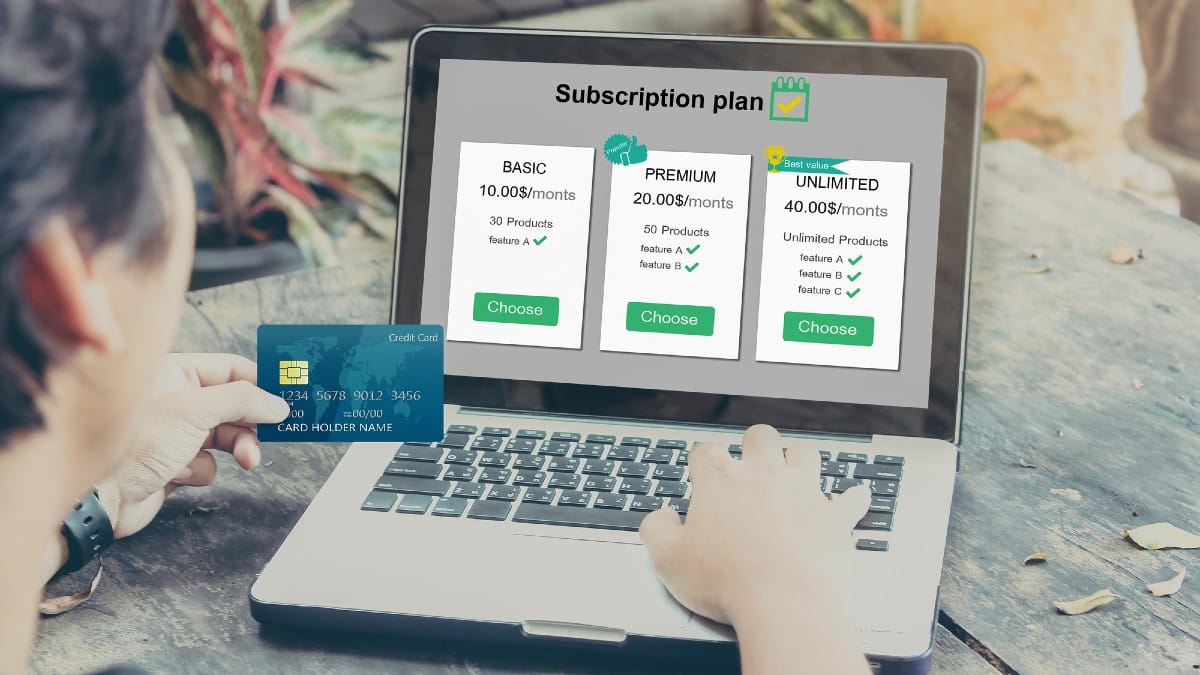

12. Regularly Reviewing Subscriptions

Regularly reviewing subscriptions is a strategic approach to financial management. It involves periodically assessing ongoing subscription services to ensure they are still necessary and valuable. This habit prevents unnecessary spending on services that are no longer used or appreciated, thereby optimizing monthly expenses.

13. Practising Energy Efficiency

Embracing energy-saving practices at home, like LED bulbs or energy-efficient appliances, reduces utility bills significantly. Think of it as fine-tuning a car to get the best mileage. Over time, the savings from these small adjustments add up.

14. Planning Meals

Meal planning is a common millionaire habit. By knowing what to cook and when they avoid expensive last-minute takeouts. It’s similar to plotting a journey before setting out, ensuring you reach your destination efficiently and economically.

15. Buying Generic Brands

Choosing generic over brand-name products can lead to substantial savings without sacrificing quality. It’s like choosing a path less traveled that still leads to the same destination, yet costs less. This smart shopping habit keeps more money in their pockets.

50 Super Simple Side Hustle Ideas

50 Super Simple Side Hustle Ideas (& How to Make Them Work)

10 Frugal Lessons I Learned From Being Flat Out Broke

10 Frugal Lessons I Learned From Being Flat Out Broke

How To Make Money Without a Job

How To Make Money Without a Job

Creative Ways To Make Money

20 Easy Ways to Raise A Credit Score Fast

Read More: 20 Easy Ways to Raise A Credit Score Fast

Frugal Living Tips: The Essential Guide To Start Saving Money

Frugal Living Tips: The Essential Guide To Start Saving Money

Get more stories from Bento Bucks on money hacks and trending money news!

Get more stories from Bento Bucks on money hacks and trending money news!