Flying solo doesn’t have to mean burning a hole in your wallet! Being single offers unique opportunities to save and splurge strategically. From whipping up delicious meals at home to exploring free cityscapes, these frugal habits will transform your finances and empower you to live life to the fullest, without breaking the bank.

1. Cook More Meals at Home

Eating out can be a major budget drain. Cooking more meals at home is a great way to save money. You can find affordable and healthy recipes online or in cookbooks. Plus, cooking at home allows you to control the ingredients and portion sizes, which can help you eat healthier and lose weight.

2. Take Advantage of Free Activities

There are many free or low-cost activities you can enjoy, such as hiking, biking, visiting museums on free days, going to the library, or attending local events. Check out your community calendar or event listings to see what’s happening in your area.

3. Skip the Expensive Coffee Shop Drinks

Coffee shop drinks can be pricey. Making your coffee at home or switching to tea or water can save you a lot of money. If you must have your coffee fix, try bringing your travel mug and asking for hot water instead of buying a pre-made drink.

4. Pack Your Lunch

Packing your lunch is a great way to save money and eat healthier than eating out. You can pack leftovers from dinner, make sandwiches or salads, or bring in healthy snacks.

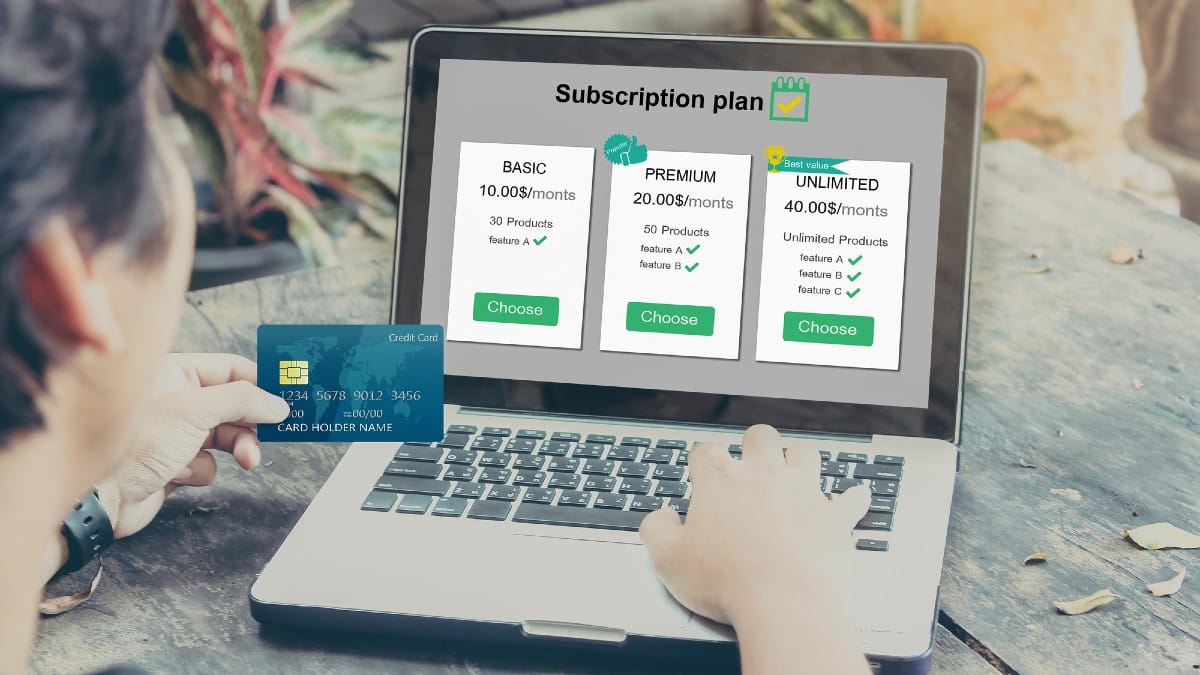

5. Cancel Unused Subscriptions

Take some time to review your subscriptions and cancel any that you don’t use or need. This includes things like gym memberships, streaming services, magazine subscriptions, and even unused apps.

6. Shop Around for Better Deals

Don’t just buy the first thing you see. Compare prices before you make a purchase. You can use coupons, shop at discount stores, or look for online deals.

7. Use Public Transportation or Bike

If you live in a city, using public transportation or biking can be a cheaper and more environmentally friendly way to get around than driving. If you must drive, carpool with friends or colleagues.

8. Avoid Impulse Purchases

Impulse purchases can quickly add up. Before making a purchase, ask yourself if you really need it and can afford it. Wait 24 hours before making a big purchase to see if you still want it.

9. Track Your Spending

It’s easier to save money if you know where your money is going. Track your spending for a month to see where you can cut back. There are many budgeting apps and tools available to help you do this.

10. Get a Roommate

If you have a spare room, consider getting a roommate. This can help you split the cost of rent and utilities. Just make sure you find a compatible roommate who respects your boundaries.

11. Negotiate Your Bills

Don’t be afraid to negotiate your bills. This includes things like your cable bill, internet bill, and even your cell phone bill. You may be able to get a lower rate or better terms by simply asking.

12. Sell Unused Items

Do you have clothes, furniture, or other items you no longer use? Sell them online or at a consignment shop. This can be a great way to declutter your home and make extra cash.

13. Take Advantage of Freebies

There are many freebies available, such as samples, coupons, and free trials. Take advantage of these offers to save money on things you need or want.

14. Do It Yourself (DIY) Whenever Possible

Instead of paying for someone else to do things like minor repairs, cleaning, or basic car maintenance, learn how to do them yourself. There are plenty of online tutorials, books, and even community workshops available to help you acquire new skills. Not only will you save money, but you’ll also gain a sense of accomplishment and self-reliance.

15. Embrace Entertainment on a Budget

Ditch the expensive outings! Instead, dive into the treasure trove of free entertainment. Take advantage of the wealth of free online resources, such as museum tours and educational courses, and borrow movies and books from your local library. Your wallet will thank you, and your soul will be enriched by experiences beyond price.

50 Super Simple Side Hustle Ideas

50 Super Simple Side Hustle Ideas (& How to Make Them Work)

10 Frugal Lessons I Learned From Being Flat Out Broke

10 Frugal Lessons I Learned From Being Flat Out Broke

How To Make Money Without a Job

How To Make Money Without a Job

Creative Ways To Make Money

20 Easy Ways to Raise A Credit Score Fast

Read More: 20 Easy Ways to Raise A Credit Score Fast

Frugal Living Tips: The Essential Guide To Start Saving Money

Frugal Living Tips: The Essential Guide To Start Saving Money